MT103-202 Receivers

What is MT103-202 Automatic/manual download and where you can find receivers?

prior to knowing swift practices I would begin my search online with any new venture that arrive at my door. It was a hot summer day in southern California. Hot as in 120F, warm enough to cook an egg on the sidewalk. Although the struggle was real it's only hot during the walk between the building you're in and your vehicle your heading out with. I was sitting in my office enjoying the air conditioned office when I received an email requesting help with an MT103-202. Now I have worked with 103s every other day but what's a 202? So I began my search and to my surprise there was very little online about it. Since that finding I have included the 202 information within bluhe university in hopes to realign it's true processes and function. Transferring funds can be a bit of a rubix cube, But, a little expertise goes a long way.

So, What is it?

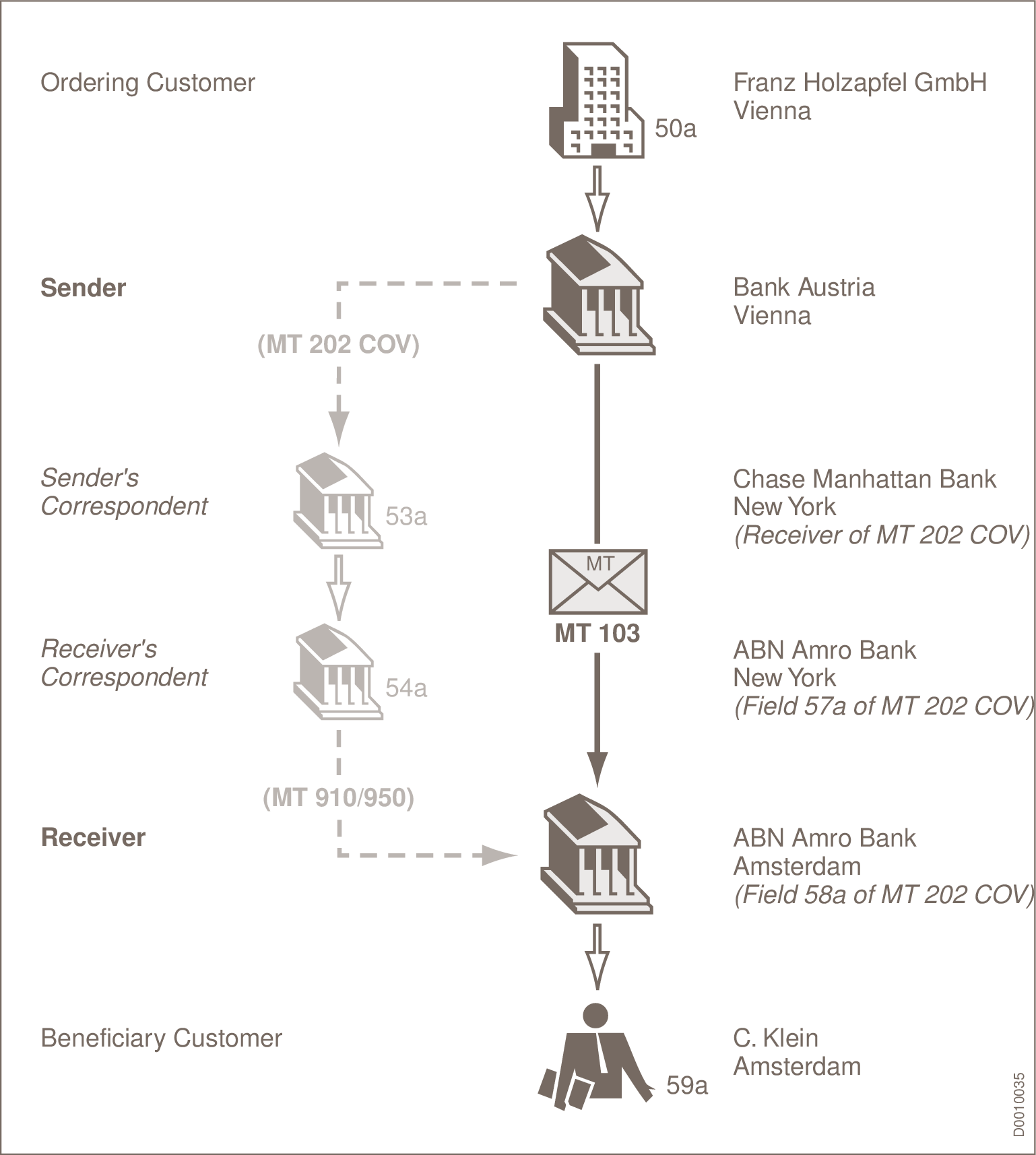

It is a bank transfer(103) that requires a corresponding bank (202)

The SWFIT Directory says it better:

MT 103 is a single direct payment.

MT 202 is an interbank order from a Corresponding bank(s)

Is it a Scam?

No, its a function created by SWIFT and used by it's customers. MT 103-202 is widely used across the world to fulfill investment opportunities, business obligations or beneficiary payouts. They can also be structure to establish private financial arrangements and private placements. So what's with all the scam talk?

Problem is that there are thousands of small banks that are privately owned and operated by sub par talent and do not carry the same quality of discipline that higher end banks do. Therefore, it leaves a vast amount of opportunity for others to take advantage of their ignorance of perfect process and procedure.

Problem with the problem is that if you are a bank and have a relationship with SWIFT then that means you have access to customer support at SWIFT. If you aren't familiar with customer service with SWIFT then get familiar. They provide experts to assist with structuring and compliance to make sure that everything is perfect. So really, if there is a scam then both parties are drinking the juice.

What is manual download?

manual download is normally presented in the form of a MT103-202 Manual Download in SWIFT. This transaction is placed into SWIFT.com by the sender but is not placed on the receiving banks LOCAL SWIFT, but rather in the GLOBAL Swift "cloud". This means the transaction must be searched by the receiving bank in global and then downloaded with separate codes that are not present on the transmission slip. Other kinds of manual download transactions are DTC, IP/IP, Semi and Manual GPI.In general, stay away from Manual as it normally indicates some form of restricted funds that require a receiver to take responsibility for the funds, via their pulling "downloading" of the funds.

What is non-download?

A Non-Manual Download transaction should terminate in the receivers settlement account and not remain in the "cloud"

What it can & can't do.

- it can be sent to a financial institution to debit an account of the Sender serviced by the Receiver and to credit an account, owned by the Sender at an institution specified in field 57.

- This message may also be sent to a financial institution servicing multiple accounts for the Sender to transfer funds between these accounts.

- This message must not be used to order the movement of funds related to an underlying customer credit transfer that was sent with the cover method. For these payments the MT 202 COV or MT 205 COV must be used.

General Process to performance.

STEP 1

General admission processes vary from each company.

Bluhe uses a State of the Art D.D. Processes SWIFT KYC registry are key components to our successful D.D. filings. All primary forms like CIS and KYC are collected at this time. Some ICC regulated countries are adopting facial recognition affirmation software in the onboarding process. In the event of facial recognition requirements, Bluhe Shire is available to record for issuance.

STEP 2

Private Structures for Unique Clients

For owners and investors who are investing in multiple places or require funds to be delivered to multiple locations for trade, then a private financial agreement will be placed within the file to fulfil audits placed by any government entities involved.

STEP 3

The Initial Tranche

Most Large files that are valued over $10,000,000 will begin with an initial tranche of a smaller amount that will establish connection and reliability between all working bank entities. Most initial tranches start at $100,000. Delivery time will depend on the location of all acting parties.

Looking for a receiver?

We have the entire globe covered.